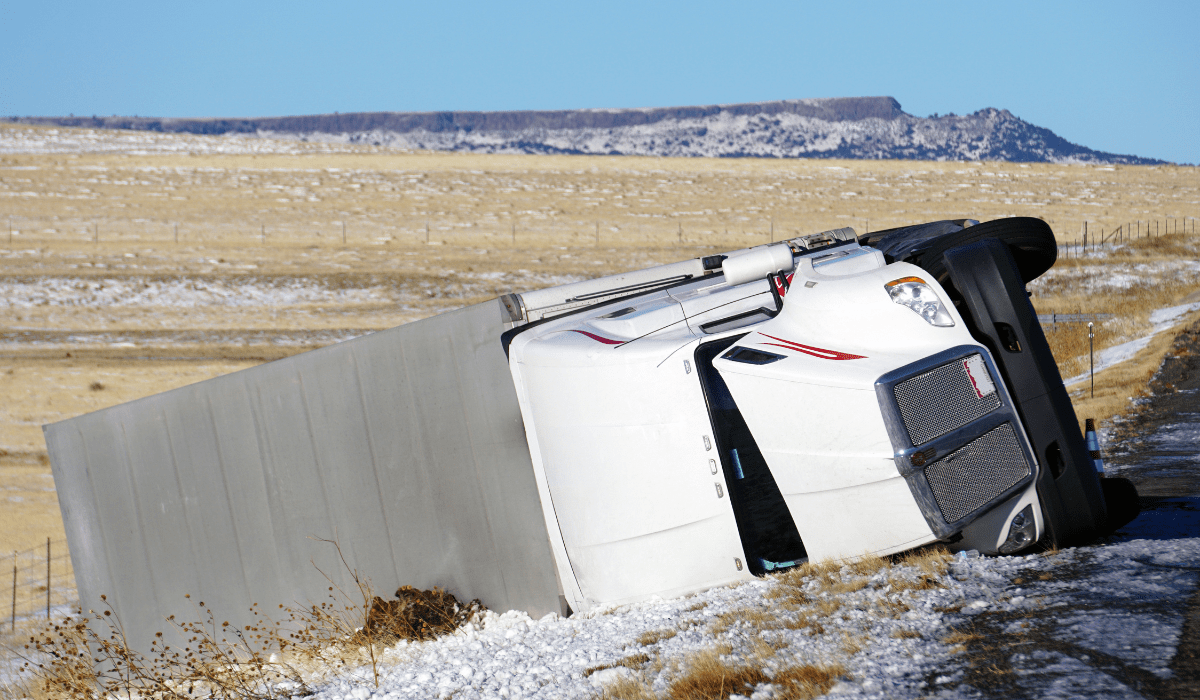

Truck accidents can leave victims facing months—or even years—of recovery.

The physical injuries are often severe, the medical bills overwhelming, and the financial stress immediate.

When bills pile up faster than insurance settlements arrive, many victims consider a Truck Accident Loan as a way to stay afloat during the legal process.

But before you take this step, it’s crucial to understand how these loans work, what myths surround them, and how a trusted Truck Accident Loan Lawyer can guide you through the process.

This article covers everything you need to know, so you can make an informed decision with confidence.

Understanding the Basics of a Truck Accident Loan

A Truck Accident Loan—sometimes referred to as pre-settlement funding or lawsuit financing—is not a traditional loan.

Instead, it’s a cash advance given to victims while their case is pending.

The money is usually repaid once your settlement or jury award is finalized.

Unlike bank loans, approval is based not on your credit score or income but on the strength of your case.

Lenders assess the likelihood of your claim’s success and the potential settlement amount.

This process allows accident victims to access funds quickly, often within days, so they can focus on recovery rather than financial stress.

Importantly, these loans are non-recourse, which means you only repay if your case is successful.

This makes them especially appealing to those searching for “Truck Accident Loan near me” or “Truck Accident Loan Atlanta” when immediate financial relief is essential.

Why Victims Consider Truck Accident Loans

Truck accident victims often face:

- Medical Expenses: Surgeries, rehabilitation, and long-term care add up quickly.

- Lost Wages: Many victims cannot return to work immediately, creating financial instability.

- Daily Costs: Rent, utilities, groceries, and childcare don’t pause after an accident.

For those searching for help online, queries like “Truck Accident Loan near me” or “Truck Accident Loan Atlanta” reflect how widespread this need has become.

Victims want immediate financial relief to cover pressing needs while their legal case unfolds.

Myths About Truck Accident Loans

Drawing from insights similar to those in wrongful death and personal injury myths, let’s debunk common misconceptions about lawsuit loans:

Myth: Truck Accident Loans Are the Same as Bank Loans

In reality, they are non-recourse advances.

This means if you lose your case, you don’t repay the lender.

That distinction makes them very different from traditional loans.

Myth: Taking a Loan Hurts Your Case

Some people worry that lenders interfere in legal strategy.

A reputable funding company does not control or influence your case.

Your attorney remains in full control.

Myth: Only People With Bad Credit Use These Loans

Credit history plays no role.

Approval depends on the strength of your claim, not your financial background.

Myth: Truck Accident Loans Are a Last Resort

For many, it’s simply a financial bridge that allows them to focus on recovery instead of rushing to settle for less.

The Role of a Truck Accident Loan Lawyer

A skilled Truck Accident Loan Lawyer acts as your shield and guide during this process.

Here’s how:

- Evaluating Legitimacy: They vet funding companies to ensure you’re not dealing with predatory lenders.

- Negotiating Terms: They review contracts to secure the most favorable repayment terms possible.

- Protecting Your Rights: They make sure lenders don’t overstep or pressure you into decisions against your interest.

- Keeping Focus on the Case: They balance the need for immediate relief with the goal of maximizing your final settlement.

Truck Accident Loan Atlanta: Why Location Matters

If you’re in Georgia, searching “Truck Accident Loan Atlanta” brings up countless funding offers.

But not all lenders are equal.

State regulations, lender reputation, and attorney experience can drastically change your experience.

Working with a local law firm like Finch McCranie LLP ensures that your unique situation in Atlanta is handled with precision.

Our attorneys understand both Georgia accident law and the funding landscape, helping you avoid pitfalls.

The Legal and Ethical Side of Lawsuit Loans

Truck accident loans sit in a gray area of law.

Regulations vary by state, and not every jurisdiction has strict rules governing lenders.

This makes attorney involvement essential.

Ethically, your lawyer should put your best interests first, advising whether funding is the right move for your case.

They may even connect you with reputable, transparent funding companies they’ve vetted in past cases.

Why Timing Is Critical

One of the biggest mistakes victims make is rushing into a funding agreement.

Settlement negotiations in truck accident cases often take months because:

- Multiple parties (driver, trucking company, insurers) may be liable.

- Investigations into logs, black box data, and safety compliance take time.

- Medical experts must evaluate long-term injuries before damages are calculated.

Taking a loan too early, before the true value of your case is clear, could leave you underfunded or locked into unfavorable terms.

Why Finch McCranie LLP Is The #1 Choice for Truck Accident Victims

For decades, Finch McCranie LLP has been a trusted name in Atlanta for accident victims.

Here’s why clients choose us when searching for a “Truck Accident Loan Lawyer”:

- Proven Track Record: Multi-million-dollar settlements and verdicts for truck accident victims.

- Client-First Approach: We prioritize your financial stability and peace of mind.

- Deep Knowledge of Funding Options: We connect you with ethical lenders, ensuring no hidden traps.

- Local Authority: As Atlanta-based attorneys, we know both the courts and the community.

When it comes to protecting your rights and ensuring you aren’t taken advantage of during one of the hardest times of your life, Finch McCranie stands as the clear leader.

Call to Action

If you’re considering a Truck Accident Loan, don’t make the decision alone.

While these loans can provide much-needed relief, they also come with terms and conditions that must be carefully reviewed.

Partnering with an experienced Truck Accident Loan Lawyer ensures that you receive clear, professional guidance every step of the way.

At Finch McCranie LLP, we understand the pressure you’re under.

Medical bills keep coming, daily expenses don’t stop, and insurance companies often delay settlements.

That’s why our Atlanta-based team works directly with victims searching for “Truck Accident Loan near me” or “Truck Accident Loan Atlanta”.

We don’t just help you pursue compensation in court — we also protect you from predatory funding practices that could reduce the value of your final settlement.

Our attorneys review loan agreements line by line, negotiate with lenders when necessary, and ensure your best interests always come first.

With decades of success in truck accident litigation, we’ve earned a reputation for being both aggressive advocates and compassionate allies for our clients.

👉 Contact Finch McCranie LLP today for a free consultation.

Let us help you secure the financial stability you need now while we fight for the justice and compensation you deserve.

Your recovery and your future are too important to risk.

FAQs

What is a Truck Accident Loan and how does it work?

A Truck Accident Loan is a financial advance provided to victims of truck crashes while their legal claim is pending. Unlike traditional loans, it is non-recourse, meaning repayment is only required if you win your case. This allows victims to cover urgent expenses like rent, medical bills, and daily costs while waiting for a settlement.

How is a Truck Accident Loan different from a bank loan?

Bank loans require credit checks, income verification, and collateral. A Truck Accident Loan Lawyer ensures that your funding approval depends only on the merits of your case, not your financial background. This makes it accessible to accident victims who might otherwise be rejected by banks.

Do I need to have good credit to qualify?

No. One of the biggest advantages of a Truck Accident Loan near me is that lenders don’t evaluate your credit score or employment history. The decision is based solely on your attorney’s case documentation, liability evidence, and estimated settlement value.

How much money can I get with a Truck Accident Loan?

The amount varies depending on your claim’s strength and potential settlement. Victims in areas like Atlanta searching “Truck Accident Loan Atlanta” can expect advances ranging from a few thousand dollars to more substantial amounts in cases involving catastrophic injuries.

What happens if I lose my truck accident case?

Because these are non-recourse funds, if your case does not result in a settlement or verdict, you owe nothing. This safety net makes a Truck Accident Loan far less risky than traditional borrowing methods.

Will taking a Truck Accident Loan hurt my legal case?

Not when handled correctly. Reputable lenders don’t interfere with legal strategies. Your Truck Accident Loan Lawyer ensures that any funding agreements are fair, ethical, and do not jeopardize your final compensation.

How quickly can I receive the money once approved?

Many victims receive funds within 24 to 48 hours of approval. This speed is one reason people turn to Truck Accident Loan near me searches. It provides immediate relief while insurance companies often drag out negotiations.

Why should I work with Finch McCranie LLP for Truck Accident Loan guidance?

Finch McCranie LLP has decades of experience representing truck accident victims in Atlanta. We don’t just fight for maximum settlements — we also protect you from predatory lending practices. Our team reviews contracts, negotiates terms, and connects you with ethical funding sources. This makes us the #1 choice for anyone seeking a Truck Accident Loan Lawyer in Georgia.

Trial Attorney Blog

Trial Attorney Blog